INTRODUCTION TO CRYPTOCURRENCIES

– Oscar Tapia, Associate, Seale & Associates

This publication is the first of a series of texts that aim to provide a source of learning for those interested in learning more about cryptocurrencies. My idea is to make the texts simple and easy to follow regardless of the knowledge with which the reader tells about the subject. In addition to exposing basic aspects of the technology, economic, philosophical, financial, ideological and other subjects of personal interest and of the community that surrounds the world of digital currencies will be discussed. Some of the topics to be discussed in this and future publications (not necessarily in this order) will be:

- What are cryptocurrencies and how do they work? Blockchain, history

- What is money? and current system: Properties and history of money, current system

- Types of cryptocurrencies: By functionality, specifications

- Benefits and uses of cryptocurrencies

- Massive adoption

- Scalability and limitations

- Cryptocurrency as a new asset class: Savings instruments and portfolio diversification tool

- Investing in cryptocurrencies: Ecosystem, market participants, valuation frameworks

- Potential and ideas: Cryptocurrencies as a tool for economic development, current impact and ideas for the future

- Challenges for society: Government, control, regulation

It is worth mentioning that I do not intend to explain all the technical aspects behind this technology because 1) I am not an expert in programming, mathematics, cryptography and other fields of studies on which cryptocurrencies are built and 2) my goal is to be a source of familiarization and learning of this technology as well as to explain reasons of its importance and the value that they have in the present and will have in the future for us.

I) What are cryptocurrencies and how do they work?

The cryptocurrencies are a new class of assets designed to serve as a means of exchange between people based on fields of study such as cryptology, math and game theory. The first cryptocurrency was designed in 2008 and entered into circulation for the first time in 2009; That first cryptocurrency is Bitcoin.

As of today there are more than 850 cryptocurrencies in circulation that in total have a market capitalization (amount of coins in circulation for their value in USD) of ~ US$140 billion or ~ MX$2,520 million and the amount of coins is expected and its value continues to increase in the near future.

The first cryptocurrencies such as Bitcoin and Litecoin were conceived as means of transfer and conservation of value as any sovereign currency and precious metals such as gold and silver. Subsequently, other uses have been developed, including content distribution platforms such as YouTube, social networks such as Facebook and storage sites such as Dropbox, just to mention a few. There are currently +100 industries that are looking to be innovated through the use of technology behind cryptocurrencies.

Who invented cryptocurrencies?

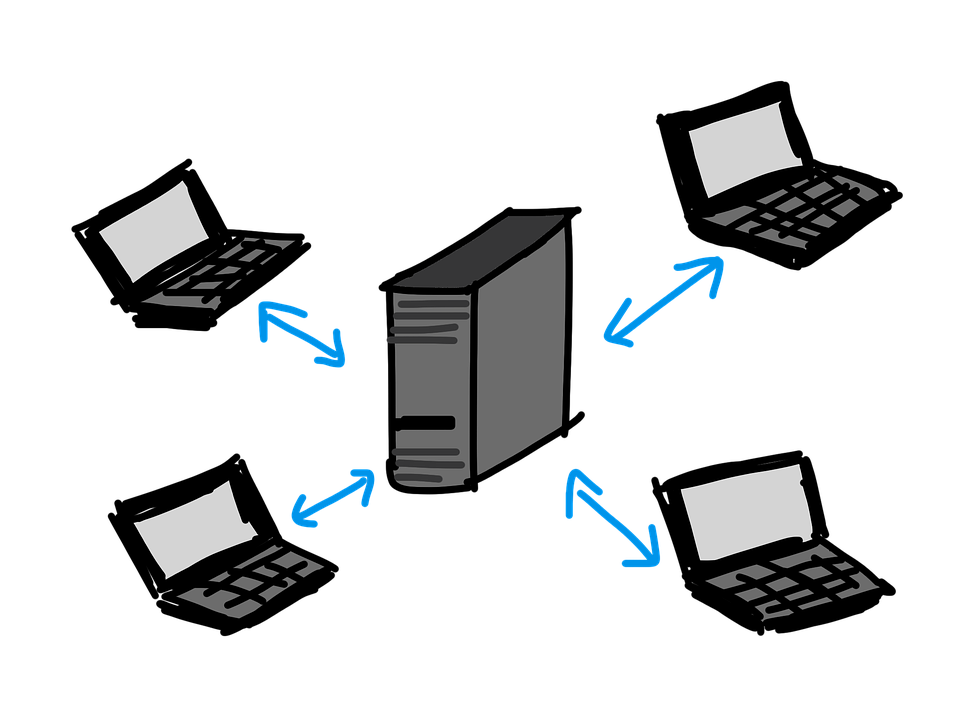

In October 2008, an author or group of authors under the pseudonym Satoshi Nakamoto published a text called “Bitcoin: A Peer-to-Peer Electronic Cash System” in which the foundations are proposed on which a decentralized digital currency is proposed, that is to say, that it does not depend on or be supported by a central authority (government) and that it does not require an intermediary to be carried out but that it is entirely maintained by the network of users (nodes) that use it. E n January 2009 published the first open source software and sapped (explained below) the first block giving birth to Bitcoin (BTC).

How do cryptocurrencies work?

The cryptocurrencies are based on a technology known as “Blockchain” proposed by Nakamoto in its original text. The blockchain is nothing more and nothing less than a general ledger (where accounting transactions are stored and recorded) distributed (anyone can have a copy of the general ledger) and it is programmed to be updated every certain amount of time, in Bitcoin, The average time between each “block” or record in the general ledger is a little less than 10 minutes. These blocks concentrate all the transactions made in that space of time and are validated by the users in order to maintain the integrity of the network. If there is a block that is adulterated or different from the rest, it is automatically discarded and invalidated, so it is not part of the chain. Once the block is integrated into the chain, the latest version of the general ledger is synchronized to all the nodes, ensuring that everyone has the same records and repeating the process. This mechanism is what keeps the network safe and reliable for all participants. Additionally, the chain can be audited by any user or person, increasing trust in the network for all users.

The participants (nodes) who act as validators and protectors of the network are known as miners. The miners use computer processing power (electricity) to solve a math problem designed by the system. The first node to solve the problem is rewarded with coins for the service provided to the network as well as to compensate for the expenses incurred in carrying out this task; in the case of Bitcoin, the reward is 12.5 BTC (around US$50,000 as of today). This mechanism serves several purposes: the main one is to keep aligned the interests of the network and the miners, since to be able to receive a reward, there is a greater incentive for the miners to behave honestly. Second, the more processing power there is in the network, the more secure and stable it becomes, so it is also beneficial for users. Finally, having to incur in an expense prevents spam attacks that could saturate the network. As a summary, mining has two objectives: 1) Ensuring the integrity of the network and 2) Establishing the mechanism through which new currencies are introduced into the system. Not all currencies work with this mechanism called POW (Proof-of-Work), however it was the first and is currently the most updated. Later in the series we will see the different systems used to keep the participants in these honest networks.

The innovation brought by this new technology is based on a single idea: counterparty risk disappears by allowing people who do not know each other to transfer value through a mechanism that does not require an entity or intermediary that certifies both parties, by means of a fair, open system, with clear and transparent rules for all.

I.II) Are cryptocurrencies money?

The first reaction that many people have when they read or hear that Bitcoin is a form of digital money is one of skepticism. Why is it valuable if there is nothing to back it up? How can I trust a currency that is not regulated? Who and how is value determined? These are some of the most common questions. To better understand the answer to these questions, I would like us to step back and talk about the concept of money first.

What is money?

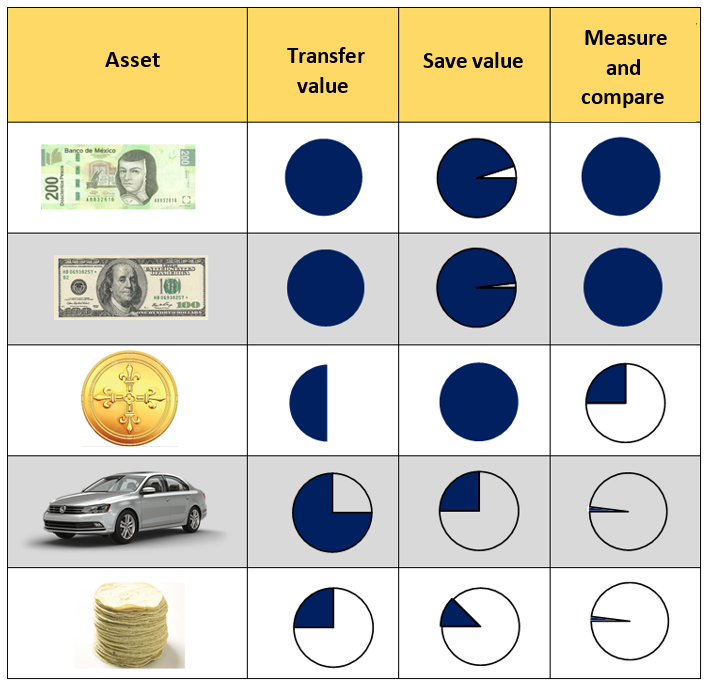

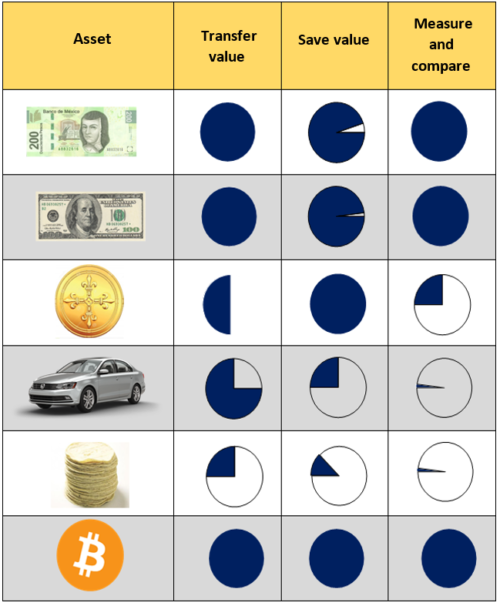

Money is a tool that facilitates the exchange of goods and services in a society. By definition, for an asset to be considered money, it must fulfill the following three functions:

- Be an instrument to transfer value

- Be an instrument to save value

- Be an instrument that can be used to measure and compare value.

To make it clearer, let’s take an example: The Mexican peso is considered money because I can transfer value with it when paying for a good or service that is being consumed. It also serves to conserve value because I can have it in my bank account to use it in the future. Finally, it also fulfills the third property because I can use it to compare two assets based on the Mexican peso, for example, I can know what the value in pesos is of both a kilo of tortilla and a car wash service as well as compare them.

On the other hand, a car is not considered money because although I can use it to transfer value (to pay a debt with it for example) is not very good at saving value (depreciates over time and use) and I cannot measure and compare value based on a car. How much is a kilo of tortilla worth? 0.0003 Jetta? It is simply not practical.

Comparison of functions of different asset classes

Comparison of functions of different asset classesIn addition to these three functions, money has some properties: First of all, it is good to preserve value; For example, a 100-peso bill can buy me the same today and tomorrow but can you buy the same thing in a year? In ten? Just look a few years ago to realize that 100 pesos do not buy you the same today to say in 2010. Despite this, it can be argued that the peso does more or less a good job in preserving value especially if we compare it with a car or a kilo of tortillas for example. Another property is the portability, take as an example the gold, if I wanted to make an international transfer, it would be enough to give a click to be able to send millions of pesos to anywhere in the world instantly, on the contrary, transporting large amounts of gold is not only unpractical, but also expensive. A third property is that it is fungible, that is, interchangeable between its different units. For example, a 50 peso bill, two bills of 20 and a coin of 10 equal a 100 peso bill. Finally, the money must be easily identifiable and durable.

History of money

Now that we have better defined what money is and some of its attributes, I would like to continue with a brief history of money and how we got to where we are today.

The history of money is as old as that of the human race. There is a consensus among the scientific community that the first forms of exchange were through barter. Bartering has several limitations, first of all it is not very liquid since to do it you must find another person who wants to exchange the good or service that you look for in exchange for what you have, besides, the majority of goods and services are not divisible, which hinders the exchange. Additionally, the barter does not serve to measure or compare value between different asset classes. Imagine that I produce corn: if I wanted to buy eggs, a car and a haircut, I would have to price the corn in eggs, cars and haircuts and so on for all the goods and services instead of pricing in a single medium of exchange as it is the peso or the dollar.

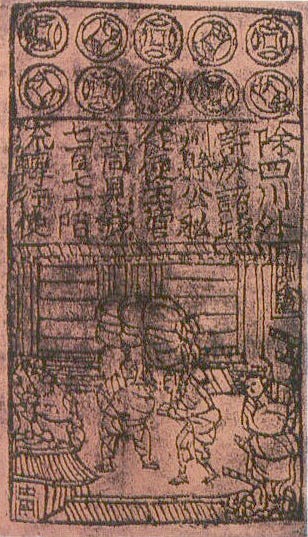

After the barter, around 5,000 years ago, the first precious metals such as gold and silver were used to be used as means of exchange and conservation of value. There is evidence of coins of different metals that were used in ancient civilizations such as Mesopotamia. This allowed, in addition to a more efficient system than the barter, to facilitate the exchange between different civilizations for their portability and acceptance among different people. Subsequently, a few hundred years ago, the first forms of paper money began to be used. These were used as promises of payment and were backed by precious metals.

The “Jiaozi” of the Tang dynasty in China (7th century) was used as money paper

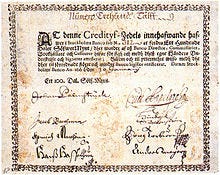

In Europe, the adoption of paper money did not come until after the end of middle age, and over a few years, it replaced coins made of precious metals completely as the preferred exchange method.

First paper money used in Europe. It was issued by the Bank of Stockholm in 1666

First paper money used in Europe. It was issued by the Bank of Stockholm in 1666

This gave rise to the gold standard, widely adopted by most countries consisting of the issuance of paper money backed by gold reserves. In 1944 an agreement known as the Bretton Woods Agreement was finalized in which 44 countries agreed to the creation of sovereign currencies fixed to the dollar while the dollar was fixed to gold. In 1971, the United States government canceled the convertibility of the dollar to gold and this is how most of the currencies in the world were without any support other than the promise of payment from the issuing government. This system is known as fiat money and is used by most countries today. This means that pesos, dollars and other sovereign currencies unlike popular beliefs, are not backed by anything more than a promise to pay, in the case of Mexico, the Bank of Mexico. A 100 peso bill is worth that because we trust that tomorrow someone else will accept it and take it as valid for a value equivalent to 100 pesos without having an intrinsic value. Recall that at the end of accounts, a ticket is a piece of paper.

With the advancement of technology and the Internet came new innovations such as digital money, credit cards and payment systems such as Paypal.

Until 2009 …

The case of digital currencies as money

Digital coins fulfill the functions of money and also share their properties. Take Bitcoin as an example: Bitcoin can be used to make value transfers almost instantaneously and at a very low cost anywhere in the world. It also fulfills the function of conserving value, it is enough to have a “Wallet” to store them safely. Additionally, Bitcoin is highly portable, liquid, divisible (up to 8 units), that is, the smallest unit of Bitcoin is 0.00000001 BTC also known as “Satoshi” in honor of its creator and is also highly secure and virtually indestructible.

Comparison of functions of different asset classes

Comparison of functions of different asset classesIt is for these reasons that Bitcoin and other cryptocurrencies can be considered as a form of money.

Like the current monetary system based on a promise of payment and a collective agreement to be accepted as a means of payment, Bitcoin has value because its network of users has determined it based on supply and demand. In addition, Bitcoin generates value to society today by being used as an additional tool for trade, it also offers a savings option to populations that do not have access to banking and serves as a hedging tool for sovereign currencies as it is happening now in Venezuela and other countries with economic and political crises among many other benefits that will be detailed later in the series.

Evolution of money through history

Evolution of money through history